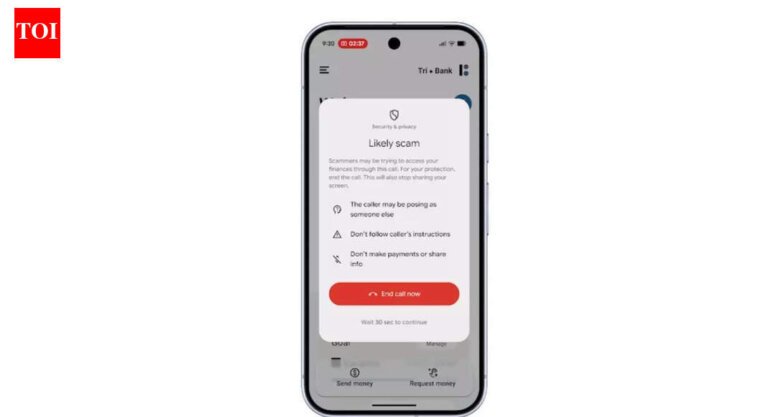

Android users face increasing cyber threats as we approach 2026, with AI-driven malware and ransomware becoming more prevalent. The antivirus market has evolved to include advanced features like real-time threat intelligence and integrated privacy tools.

Norton Mobile Security is noted for its machine learning-powered malware detection, VPN, app advisor, and dark web monitoring, achieving a 99.9% detection rate. TotalAV offers user-friendly antivirus scanning and system optimization, with features like real-time phishing protection and cloud-based scanning. Aura Antivirus combines antivirus with identity theft protection and family safety features, excelling in AI-driven behavioral analysis. Bitdefender Mobile Security is recognized for its lightweight design, anti-theft features, and effective web protection. McAfee Mobile Security provides secure Wi-Fi scanning and IoT integration, with high user satisfaction reported.

Norton leads in predictive analytics, while TotalAV includes a VPN for remote workers. Aura offers family-oriented tools and compliance-friendly features, incorporating blockchain technology for secure identity verification. Bitdefender is efficient in battery usage and has a high detection rate. McAfee supports multi-device protection and has strong customer support.

Norton’s dark web monitoring helps prevent identity theft, and TotalAV blocks trackers and ads. Aura links antivirus protection to financial security with credit monitoring. Bitdefender automates threat responses and has a strong anti-ransomware module. McAfee scans for vulnerabilities in smart devices and provides threat intelligence feeds.

Future developments may include quantum-resistant encryption. TotalAV is praised for its user interface, while Aura encourages user feedback for improvements. Bitdefender uses machine learning to reduce false positives, and McAfee employs predictive modeling for personalized security.

Organizations must evaluate antivirus solutions based on integration with existing security frameworks, cost, and performance impact. Emerging trends include biometric authentication and deeper hardware-level security protections.