CrowdStrike Holdings (CRWD) will release its fiscal Q2 2025 financial results on August 28, with analysts projecting earnings of [openai_gpt model="gpt-4o-mini" prompt="Summarize the content and extract only the fact described in the text bellow. The summary shall NOT include a title, introduction and conclusion. Text: Cybersecurity firm CrowdStrike Holdings (CRWD) is preparing to unveil its fiscal Q2 2025 financial results on August 28. The company has experienced a notable boost from the ongoing trends in artificial intelligence, with analysts projecting earnings of [cyberseo_openai model="gpt-4o-mini" prompt="Rewrite a news story for a business publication, in a calm style with creativity and flair based on text below, making sure it reads like human-written text in a natural way. The article shall NOT include a title, introduction and conclusion. The article shall NOT start from a title. Response language English. Generate HTML-formatted content using tag for a sub-heading. You can use only , , , , and HTML tags if necessary. Text: Cybersecurity firm CrowdStrike Holdings (CRWD) is set to release its fiscal Q2 2025 financials on August 28. The company has significantly benefited from AI trends, with analysts predicting earnings of $0.97 per share and revenues of $958.3 million. These figures represent year-over-year increases of 31% and 30%, respectively, according to TipRanks.

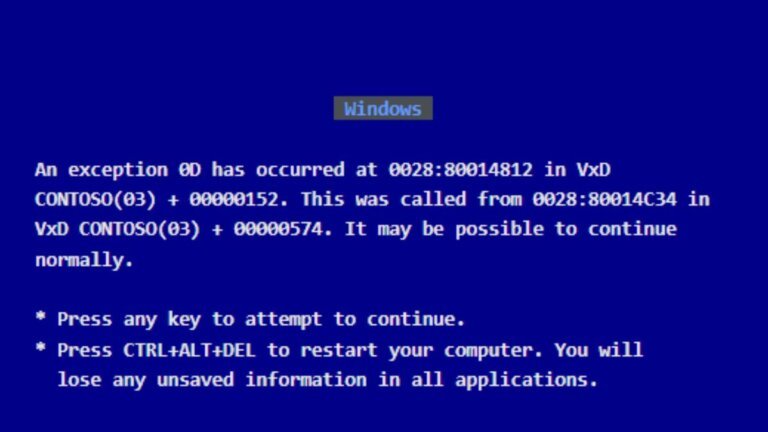

As we approach Q2, it’s crucial to note that CrowdStrike stock has faced significant declines recently. A global IT outage in July, triggered by a faulty update from CrowdStrike, led to a drop in its share price. This incident had widespread repercussions, impacting banks, airlines, and emergency services worldwide. In the past three months, the stock has fallen by 23.3%.

While analysts forecast growth in both revenue and earnings for Q2, the financial and reputational fallout from the outage remains unclear. This uncertainty raises concerns about its potential impact on CRWD’s upcoming results.

Analysts’ Mixed Sentiment on CrowdStrike Amidst Recent Outage

According to TipRanks’ Bulls Say, Bears Say tool, bears contend that CrowdStrike’s recent outage revealed Quality Assurance issues, potentially causing customers to delay purchases. They also believe the outage stalled many deals, creating a moderate headwind to Q2 FY25 ARR (Annual Recurring Revenue). Additionally, they expect management to reduce Q3 ARR projections to about $200 million.

Nevertheless, bulls view the current stock pressure as a compelling buying opportunity. They highlighted that in a Zero-Trust environment, the importance of endpoint security is growing, and CrowdStrike is well-positioned to be a key player in the cyber platform market.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.93% move in either direction.

Is CrowdStrike a Buy or Sell?

Ahead of Q2, most Wall Street analysts have maintained their Buy ratings on the stock over the past week, with the exception of Deutsche Bank’s Brad Zelnick, who is among the top 1% of Wall Street experts and has maintained a Hold rating on CRWD.

Based on analysts’ consensus ratings, CrowdStrike stock is a buy ahead of Q2 earnings. It sports a Strong Buy consensus rating, reflecting 30 Buy, six Hold, and one Sell recommendations. At an average price target of $339.65, the average CRWD stock price target implies 27.75% upside potential.

See more CRWD analyst ratings

Disclosure " temperature="0.3" top_p="1.0" best_of="1" presence_penalty="0.1" ].97 per share and revenues reaching 8.3 million. These anticipated figures reflect impressive year-over-year growth of 31% and 30%, respectively, as reported by TipRanks.

As the second quarter approaches, it is important to acknowledge that CrowdStrike's stock has encountered considerable declines in recent weeks. A global IT outage in July, caused by a problematic update from CrowdStrike, resulted in a significant drop in share price. This incident had far-reaching effects, impacting banks, airlines, and emergency services across the globe. Over the past three months, the stock has seen a decline of 23.3%.

Analysts’ Mixed Sentiment on CrowdStrike Amidst Recent Outage

According to the Bulls Say, Bears Say tool from TipRanks, bearish analysts argue that the recent outage has exposed quality assurance issues within CrowdStrike, potentially leading customers to postpone purchases. They also suggest that this incident may have stalled several deals, presenting a moderate challenge to the company's Q2 FY25 Annual Recurring Revenue (ARR). Furthermore, they anticipate that management might lower Q3 ARR projections to around 0 million.

Conversely, bullish analysts perceive the current pressure on the stock as an attractive buying opportunity. They emphasize that in a Zero-Trust environment, the demand for endpoint security is on the rise, positioning CrowdStrike as a pivotal player in the cyber platform market.

What Do Options Traders Anticipate?

Utilizing TipRanks’ Options tool, we can glean insights into what options traders expect from the stock following its earnings report. The anticipated earnings movement is calculated by assessing the at-the-money straddle of the options closest to expiration after the announcement. According to the tool, options traders are currently forecasting a 9.93% move in either direction.

Is CrowdStrike a Buy or Sell?

As we near Q2, the majority of Wall Street analysts have upheld their Buy ratings on the stock over the past week, with the exception of Deutsche Bank’s Brad Zelnick, who ranks among the top 1% of Wall Street experts and has opted for a Hold rating on CRWD.

Based on the consensus among analysts, CrowdStrike stock is considered a buy ahead of the Q2 earnings release. It boasts a Strong Buy consensus rating, comprising 30 Buy recommendations, six Holds, and one Sell. With an average price target of 9.65, the expected price target for CRWD implies a potential upside of 27.75%." max_tokens="3500" temperature="0.3" top_p="1.0" best_of="1" presence_penalty="0.1" frequency_penalty="frequency_penalty"].97 per share and revenues of 8.3 million, representing year-over-year increases of 31% and 30%, respectively. Recently, CrowdStrike's stock has declined by 23.3% due to a global IT outage in July caused by a faulty update, which affected various sectors worldwide. Analysts have mixed sentiments; bearish analysts cite quality assurance issues from the outage that may delay customer purchases and stall deals, while bullish analysts see the stock pressure as a buying opportunity, emphasizing the growing importance of endpoint security. Options traders expect a 9.93% price movement following the earnings report. Most Wall Street analysts maintain their Buy ratings on the stock, with a consensus rating of Strong Buy, reflecting 30 Buy, six Hold, and one Sell recommendations, and an average price target of 9.65, indicating a potential upside of 27.75%.