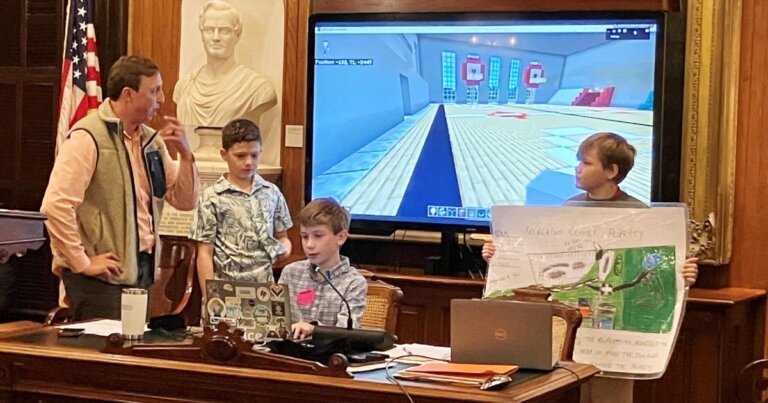

This year features several anticipated video game adaptations, including The Super Mario Galaxy Movie, Mortal Kombat II, and Street Fighter. A Minecraft Movie became the highest-grossing film in the domestic market of 2025, earning 8.3 million globally. The film's success was marked by enthusiastic audience reactions, reminiscent of The Rocky Horror Picture Show. Jack Black noted the audience's fervor and compared it to his childhood experiences with the cult classic. Warner Bros. re-released the film due to its reception, and Black's song “Lava Chicken” became the shortest hit to reach the Billboard charts. A sequel is in development, with production expected to start in April and a release date set for July 23, 2027.