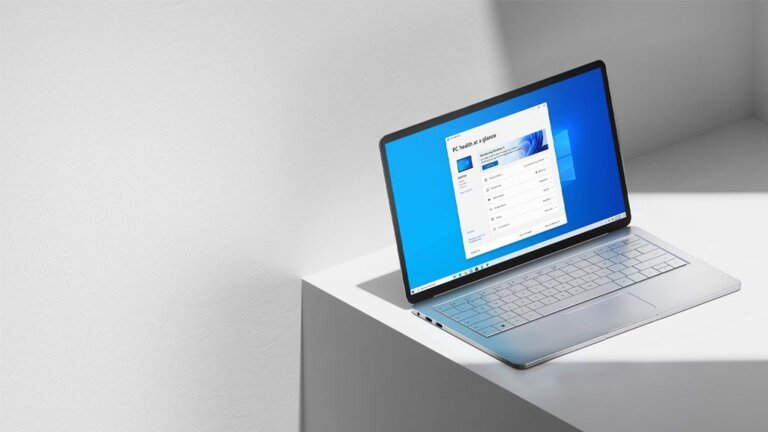

Dell's Chief Operating Officer, Jeffrey Clarke, reported a 10% to 12% lag in the migration from Windows 10 to Windows 11 compared to previous adoption rates. Approximately 500 million PCs are incompatible with Windows 11 due to its stringent system requirements. Dell has seen an increase in PC sales for 2025 but anticipates flat sales in 2026 due to rising component costs and supply chain issues. The slow uptake of Windows 11 may lead consumers to retain their Windows 10 machines or consider alternatives like Linux or macOS. Microsoft is providing extended support for Windows 10 until October 2026, allowing users more time to decide on upgrades. The future pace of migration to Windows 11 may be influenced by Microsoft's integration of AI functionalities.