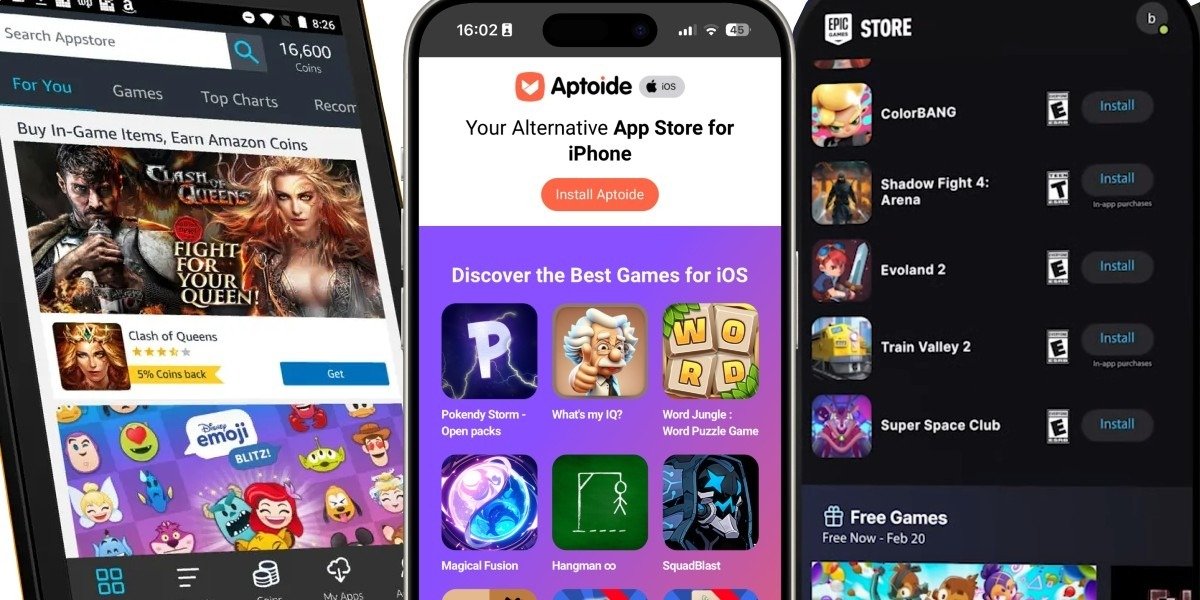

Amazon’s recent announcement to close its Android App Store on August 20th has sent ripples through the tech community, raising questions about the viability of alternative app marketplaces. With developers now unable to submit new applications, the move underscores the challenges even a giant like Amazon faces in competing with the established titans of the industry, Apple and Google.

While some may dismiss this development as inconsequential, it serves as a stark reminder of the difficulties in challenging the dominance of the App Store and Google Play. As Amazon shifts its focus toward more profitable ventures, it highlights a broader trend where large corporations can pivot swiftly, often leaving their previous initiatives behind.

Market Dynamics

The backdrop to Amazon’s decision coincides with Epic Games revealing data from its own Epic Games Store. Despite an increase in user accounts and daily active participants, player spending on PC has dipped by 18% year-over-year, amounting to 5 million in 2024. This figure excludes revenues generated by publishers through their own payment systems, a choice Epic has long championed. However, the question remains: what does this mean for the sustainability of the store in supporting third-party developers?

Similar challenges plague alternative app stores in the mobile sector. Competing against a monopoly is no small feat, and Epic’s substantial investments in its store, coupled with a strategy of offering free games, have not translated into the expected revenue growth. Steam continues to hold a commanding lead, while Epic remains closely associated with its flagship title, Fortnite, which, despite its success, does not fully alleviate the pressures on its store.

In the mobile arena, the situation appears equally daunting. Companies like Huawei and Samsung report impressive user bases—580 million and hundreds of millions of monthly active users, respectively. Yet, in Western markets, these platforms remain largely overlooked as significant revenue generators compared to their more prominent counterparts. The disparity raises questions about the actual returns developers are seeing from these alternative marketplaces.

Despite the ongoing legal battles and regulatory scrutiny aimed at the major app stores, the potential for a new marketplace to emerge as a serious competitor remains uncertain. Alvaro Pinto, co-founder and COO of app distribution platform Aptoide, remains optimistic. He notes that Amazon’s struggles come at a time when the app distribution ecosystem is beginning to evolve.

“Amazon has spent years trying to establish its Android app store, so it’s interesting that it has decided to retire it just as the app distribution ecosystem is starting to truly open up,” Pinto remarked. “While there are still significant hurdles to overcome, the shifting global regulations indicate that this is not the time to lose hope.”

Pinto emphasizes that the challenges faced by a resource-rich company like Amazon illustrate the complexities of scaling a mobile store. However, he also points to the emergence of agile, store-first approaches that are beginning to gain traction in the market.

As the landscape continues to evolve, the question remains whether new app stores can successfully shift consumer habits ingrained by years of reliance on the App Store and Google Play. The coming months may prove pivotal for alternative marketplaces seeking to carve out their niche in an increasingly competitive environment.

For those interested in delving deeper into the changing mobile landscape, including insights on alternative app stores and direct-to-consumer practices, the upcoming Pocket Gamer Connects San Francisco event on March 17th to 18th promises to offer valuable perspectives.